Continuous Quoting of Multileg Option Strategies

Two Multi-Leg Options Strategies for a Bear Market

Options activity among individual traders has declined with recent market volatility. As the herd retreats, many overlook the value of using multi-leg options strategies to potentially limit risk and generate profit in bear markets.

Multi-leg options, also called complex options, simultaneously buy or sell options of the same underlying security. They have many benefits, including:

● Time saving: Multi-leg options can save time in a fast-moving market. Instead of executing each leg of the options trade one at a time, traders can carry out a strategy with a single order and remove the time lag between each option entered manually. A slower trade using single-option orders can increase slippage as prices change between executions.

● Cost effective: Multi-leg options tend to be slightly less expensive than single-option orders because the proceeds the trader makes from selling options can offset some purchase costs. The flip side of this is that there will be slightly higher commission costs with multi-leg strategies, and profit ranges may be more limited than single-leg options.

● Versatility: Multi-leg options allow traders more versatility in their trading by offering more tools in the toolbox to take advantage of bull, bear, and neutral markets. Traders can tweak strategies to limit or increase risk as well as maximum and minimum profits, allowing a wider range of trades that can be tailored to more scenarios. Multi-leg options involve risk and are not suitable for all traders. Transaction costs may be significant in multi-leg options strategies, and advanced options strategies often involve greater and more complex risk than single-leg options. Losses with multi-leg options can be greater than the initial investment. Evaluate the benefits and drawbacks carefully.

Traders can access all the benefits of multi-leg options strategies in bear markets. Here are two of the most common multi-leg options strategies individual may use in a declining market:

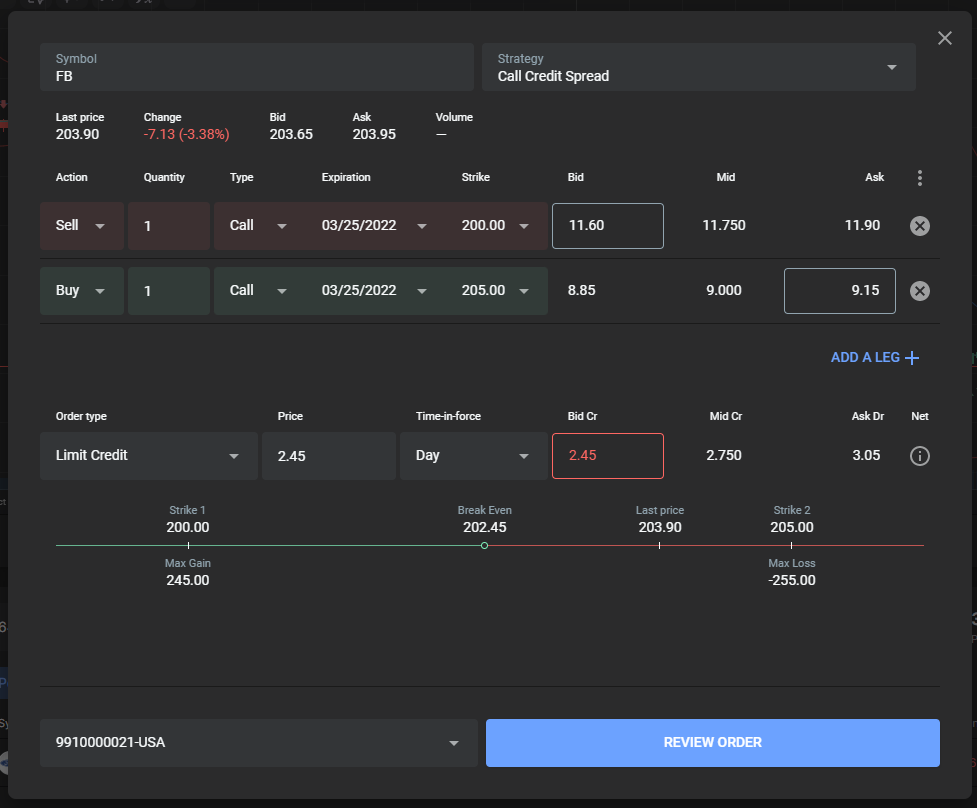

Bear Call Spread

How it works: A trader buys call options at a specific strike price while selling the same number of call options with the same expiration date, but at a lower strike price.

Pros: The bear call spread is a premium-generating defined risk trade. Traders can tailor this strategy to their risk profile with narrower spreads for conservative traders and wider ones for people with larger risk tolerances.

Cons: The maximum profit is limited with this strategy.

Real-life example: Let's use the example of Netflix stock recently at $172 with a bear call spread, known as a call credit spread.

1. If you think Netflix shares will drop, you could sell a call option with a $172.50 strike price and buy a call option with a $175 strike price using a bear call spread, also known as a call credit spread.

2. This strategy would give you a $95 credit in your Lime® Trader account, which is taking the difference of the bid on sell and the offer/ask on the buy, minus a $1 commission for two contracts.

3. The results:

• Profit: If Netflix stock moves below $173.40 and stays to the expiration date, you can keep the $95 in your account.

• Breakeven: If Netflix stock stays below $173.40, you at least break even.

• Loss: If it expires with Netflix stock above $175, you would lose a maximum of $160, which would be the cost of buying the call minus the credit your account received.

4. Keep in mind that if you don't close your position by expiration, you could end up short 100 shares of Netflix stock, and there is some risk that the stock could move before you could exit the following trading day.

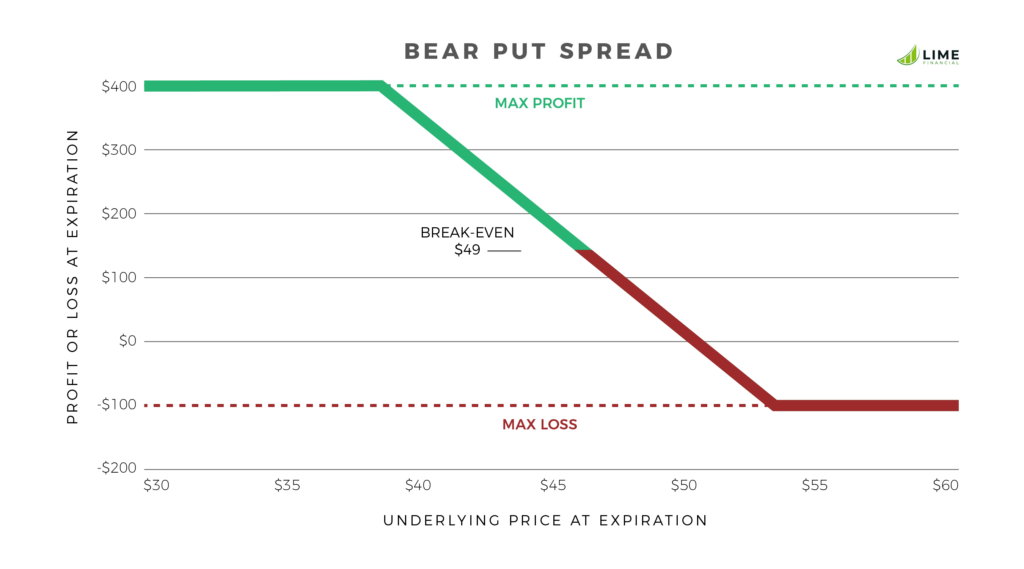

Bear Put Spread

How it works: A trader buys one put option with a higher strike price and simultaneously sells the same number of put options at a lower strike price.

Pros: The bear put spread, also known as a put debit spread, is a premium-generating defined risk trade. Traders can tailor this strategy to their risk profile with narrower spreads for conservative traders and wider ones for people with larger risk tolerances.

Cons: The maximum profit is limited with this strategy.

Real-life example: Let's use the same example of Netflix stock recently at $172 with a bear put spread, known as a put debit spread.

1. If you think Netflix shares will drop, you could buy a put option at $175 .

2. This strategy would give you a $90 credit in your Lime Trader account, minus a $1 commission for two contracts.

3. The results :

• Profit: If Netflix stock moves below $172.50 and stays to the expiration date, you can keep the $128 in your account.

• Breakeven: If Netflix stock stays below $173.78, you at least break even.

• Loss: If it expires with Netflix stock above $175, you would lose a maximum of $122, which would be the cost of buying the put minus the credit you received for selling the other put.

4. Keep in mind that if you don't close your position by expiration, you could end up short 100 shares of Netflix stock, and there is some risk that the stock could move before you could exit the following trading day.

Use a Broker Built for Multi-Leg Option

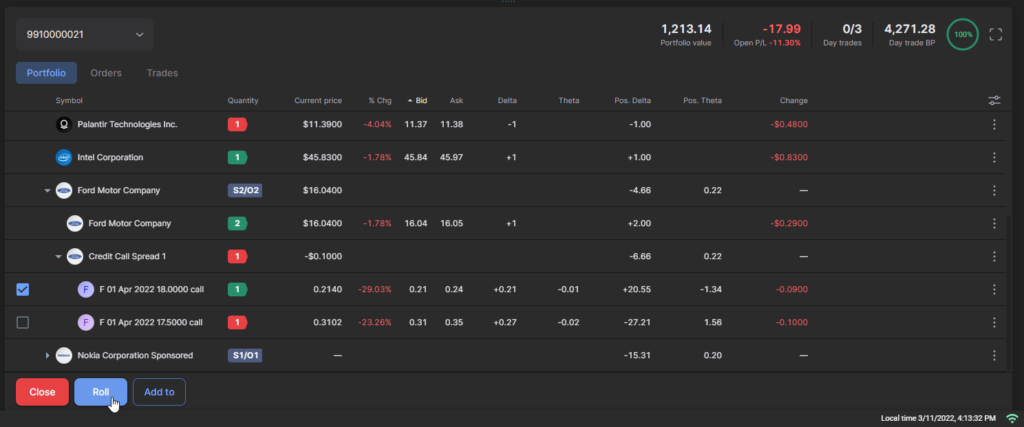

Deploying multi-leg options strategies is easier when traders have a broker designed to handle them smoothly. The ease of executing multi-leg options strategies depends on the broker's configuration. Traders should be aware of commissions owed and the broker's margin requirements. Executing as one order allows a trader to avoid the trouble of entering into a position without the worry of not getting executed on one of the legs.

Lime Trader is designed to make multi-leg options trading more accessible. The platform executes simultaneously to reduce execution risk. Lime Trader's position management features let you select and open, close or roll option legs. The position views provide rollup calculations by strategy and underlying assets, so that you can track your portfolio's P&L and Greek values.

Learn more about trading multi-leg options with our free e-book, Intro to Multi-Leg Options.

Stock symbols and company names displayed are for illustrative purposes only.

hoelscheraccurione.blogspot.com

Source: https://lime.co/two-multi-leg-options-strategies-for-a-bear-market/

0 Response to "Continuous Quoting of Multileg Option Strategies"

Post a Comment